25 Most Common Questions When it Comes to Trade (Gewerbe) Registration in Germany

The steps of a Business Set-up in Germany

July 9, 2020

Different Types of Tax for the Self-Employed Individuals in Germany

July 23, 2020The process of business registration can be a long process with durable waiting times in different offices, struggling with German language and dealing with complicated bureaucracies. But if you are a well-prepared applicant, you can make this process easier and faster. This article discusses the most common topics an entrepreneur may face during business registration in Germany.

1) Steps to follow for registering a business in Germany

Registering a business may sound difficult but it is easier than expected if you stick to some crucial rules. By following these 5 steps, you can easily register your business in Germany:

- Ask yourself if you should at all start a business in Germany!

- Study your specific business well enough to know all about the registration process.

- Gather your documents and contact the responsible offices to proceed with your application.

- Fill out all related forms.

- And finally submit your application and wait to receive your trading license.

2) what is a business?

There is no specific definition for the term “business” but if you are practicing any legal self-employed activity which is long-term and brings benefit for you, it is considered as a business. Please consider that freelancing is excluded from the definition above.

Almost everyone is allowed to start a legal business in Germany. There are of course some restrictions in special cases but in general, any type of business which does not violate German regulations is possible to perform. Every individual business application undergoes individual checks by a legislator in Germany. Different organizations will be informed about the application of businesses. Chamber of Commerce and Industry, Chamber of Crafts and the health insurance companies are to mention a few. Business registration is also an important matter for the statistics of the states and municipalities.

4. Who must register a business?

Anyone who starts a self-employment career to make a profit is subject to register his business in Germany. This excludes freelancers as mentioned earlier. Freelancers are only required to register their activity at tax authorities. In order to gain more information regarding business registration, you can refer to Section 14 Paragraph 1 Sentence 1 of the Trade Code (GewO)

5. Who is a freelancer?

If your business is not subject to registration, you are a freelancer. You can refer to § 18 of Income Tax Act (EStG) in order to find out about freelancing careers. Following is a list of careers that are not subject to registration when practiced independently and therefore considered as freelancing careers:

| Professional branch | Examples |

| Legal, business and tax advice | Lawyer, notary, patent attorney, auditor, accountant, tax advisor |

| Health professions | Doctor, dentist, veterinarian, physiotherapist |

| Technology, science | Surveying engineer, engineer, architect, trade chemist |

| Culture, communication of information | Journalist, image reporter, translator, interpreter |

6. What are other freelancing careers?

The given list in § 18 GewO is not an exhaustive list. Therefore it is advised to refer to Partnership Companies Act (PartGG) to gain more information regarding similar jobs which are considered as freelancing careers.

7. What are the typical trade jobs (typische Gewerbeberufe)?

If you are practicing any of the following business fields, you are not required to register your business:

· Wholesale and retail (for example an online shop)

· Crafts (exception: artistic activity)

· Public houses, restaurants, hotels

· Simple, household-related services (e.g. cleaning)

· wealth consultancy

8. What are the benefits of being a freelancer?

Being a freelancer is easier since you only deal with your tax registrations and nothing more. Also you are exempted from paying the trade tax. But having a closer look at disadvantages, being a freelancer is not always that great:

| Traders | freelancer | annotation | |

| Business registration? | Yes | No | The business registration is usually a relatively uncomplicated formality. |

| Simplified accounting (EÜR)? | – Possible for sales up to € 600,000 / year and- Profit up to € 60,000 / year | Always possible | EÜR and actual taxation are possible at the very beginning of commercial activity . |

| Trade tax? | Yes | No | Is of little importance because there are lower limits and trade tax is counted against income tax. (a surplus of a fixed amount will be subject to the trade tax) |

9. How do I describe my job?

If you are intending to register a business, you must be very careful with describing your business. Being either too broad or too narrow is not the best approach in defining the business. You should make sure that you mention all the values your business brings and avoid unnecessary details that do not interest the related officer.

10. When do I have to register a business?

It is very important to know that registering a business is not only necessary when you start a new business but also when you take over an existing business, moving an existing company to another city in Germany, establishing a branch in your business sector and when changing the subject of your business.

11. Is a part-time job also subject to registration?

The same regulations for business registration apply to part-time jobs. Even If you are self-employed while having an employment which is already subject to social security contributions, you should still report your activity to the responsible authorities.

12. Do I have to register my business personally?

Depending on the type of your business, the following persons are required to register the business at the responsible authorities.

| legal form | Examples | Who has to register? |

| one-man business | (self-employed as an individual) | The entrepreneur himself (owner) |

| Partnership | GbR, OHG, KG, PartG | Executive Partner |

| Corporation | AG, GmbH, UG (limited liability) | Authorized managing director |

13. Where do I have to register my business?

Depending on the state you live in, you should find and contact the responsible authority to register your business. Usually the trade office which is a part of the regulatory office is responsible for such affairs.

14. Where can I find the business registration forms?

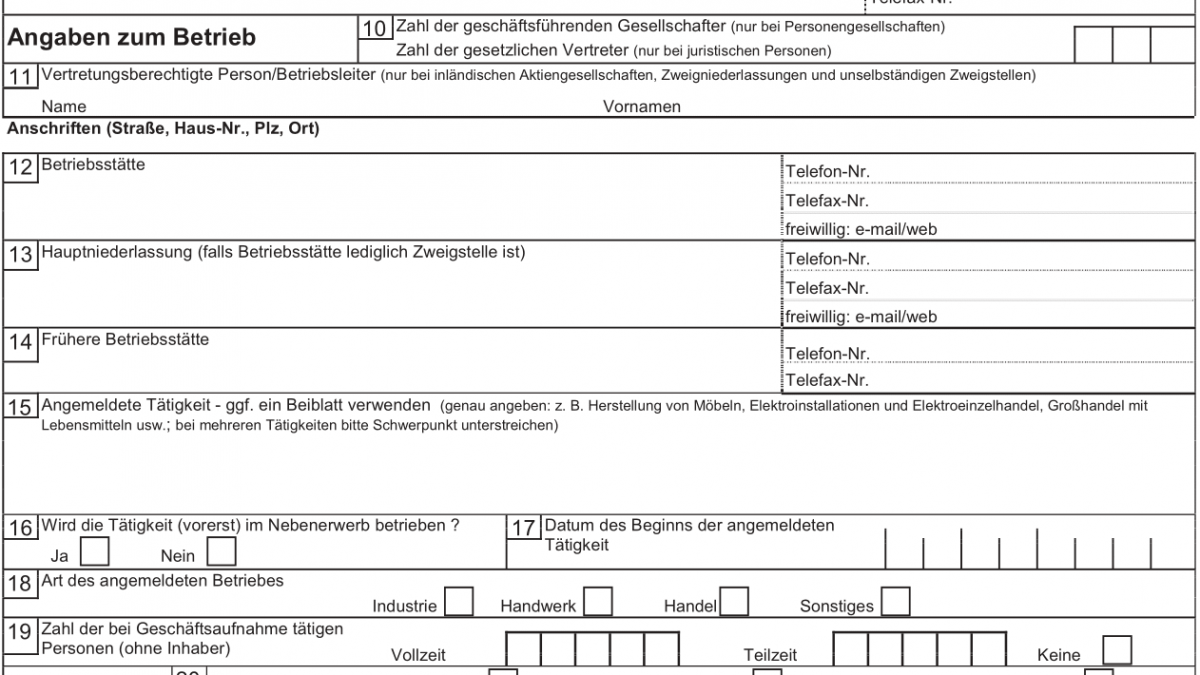

You can provide the forms from responsible authorities, but it is for sure easier to download an online version to fill in and submit the printed version of the corresponding document to the responsible authorities.

15. Can I register my business online?

Sometimes it is possible to do the whole process of business registration entirely paperless. You can find more information and online forms in the websites below:

| state | link |

| Baden-Württemberg | service-bw.de |

| Bavaria | Free State of Bavaria |

| Berlin | service.berlin.de |

| Brandenburg | service.brandenburg.de |

| Bremen | stadtamt.bremen.de |

| Hamburg | gateway.hamburg.de |

| Hesse | service platform.hessen.de |

| Mecklenburg-West Pomerania | service.mv.de |

| Lower Saxony | buergerservice.niedersachsen.de |

| North Rhine-Westphalia | Gewerbeanmeldung.nrw.de |

| Rhineland-Palatinate | bus.rlp.de |

| Saarland | buergerdienste-saar.de |

| Saxony | amt24.sachsen.de |

| Saxony-Anhalt | buerger.sachsen-anhalt.de |

| Schleswig-Holstein | schleswig-holstein.de |

| Thuringia | buerger.thueringen.de |

16. What does the trade office check when registering a business?

There are three main points that the officers check first. Your personal details, allowance of the service you want to proceed with and the necessary documents for restricted business activities. Topics such as the name of the business are later checked by authorities at chamber of commerce and chamber of crafts.

17. Which business activities require a special permit?

When it comes to freedom of trades, some restrictions come up in certain business types. As a result, these specific businesses require permissions before registration. following are some examples of business type that require liability check:

· Arcades, § 33c GewO

· Broker, § 34c GewO

· Insurance intermediary, § 34d GewO

· Insurance advisor, § 34e GewO

· Financial investment broker, § 34f GewO

It is important to mention that in some businesses such as debt collection companies, animal trades, care services, driving instructors and skilled trades, specialist knowledge must be proven in addition to other required documents.

18. What special features apply to craftsmen?

If you are intending to start a career in a craft business, you are required to prove your professional suitability to the job in addition to other necessary documents. It is important to have the following in mind when starting a career in craft business:

· Contact your local Chamber of Crafts.

· Submit your craftsmanship certificate at the responsible authority.

· You will receive a craft card, which you must present when you register for the business.

· You then need an approval from the Lower Building Inspectorate (UBA) to start your career.

Please remember that this does not apply to so-called handicraft-like trades. There is no necessity to submit a craftsman’s certificate in handicraft-like businesses.

19. Which types of business should be monitored?

· Purchase and sale of used goods: high-quality consumer goods, motor vehicles, bicycles, precious metals, etc. (Section 38 (1) No. 1 GewO)

· Credit agencies, detective agencies (Section 38 (1) No. 2 GewO)

· Marriage brokerage (Section 38 (1) no.3 GewO)

· Travel agencies (section 38 (1) no.4 GewO)

20. When do I get my business license?

The process of receiving a business license involves long waiting times in different offices but as soon as you get in direct contact with the responsible officer, it is the matter of minutes to submit your application. If you proceed with an online payment for registration fee you might be able to take the business license with yourself immediately.

21. What documents do I need for the business registration?

Make sure to have your application form along with your ID card and some cash for the registration fee. Depending on the business type, some additional documents may be required. Do not forget that in some special business you need to obtain a permission before starting your application. The main difference here is between license-free and license-requiring trades:

| License-free businesses | Businesses that require a license |

| unlimited: -No special evidence- Business license is usually issued immediately. | -Examples: Exhibition of people (§ 33a GewO) , amusement arcades (§ 33c GewO)– Business can only start with an approval.- Permission must be requested from the responsible authority.-Applicant must bring the evidence with the business registration. |

| restricted: – Businesses requiring surveillance (§ 38 GewO , for example used cars, credit agency, marriage agency)-Police certificate of good conduct, excerpt from the central trade register must be attached to the registration or can be submitted later. |

22. What do I have to consider as a non-German when registering for a business?

Citizens of EU member countries are permitted to start a business in Germany according to the law of “freedom of trading”. It is more difficult for Non-European citizens to start a business in Germany. The following chart presents the necessity for both categories when intending to start a business.

| origin | particularities |

| – EU- EFTA countries (Norway, Iceland, Liechtenstein)- Switzerland | – No special requirements |

| – All other countries of origin | – Residence permit- with the right to practice an independent business |

23. Who will be informed about my business registration?

The trade office might pass the information regarding business registration to various authorities in Germany.

• Chamber of Industry and Commerce (No. 1)

• Chamber of Crafts (No. 2)

• Federal Employment Agency (No. 5)

• Authorities for Customs Administration (No. 7)

• Register Court (No. 8)

• State Offices for Statistics (No. 9) are among the authorities that may be informed. Your data may also be transferred to other institutions such as the tax office in accordance with § 138 AO (tax code) which saves you an additional visit to tax authorities.

24. Can I register my business retrospectively?

Registering your business after a week of the actual start should not be a problem but according to § 14 Paragraph 1 Clause 1 GewO, the registration of the business must take place at the same time as the start of operation. In case you register your business too late, you may be entitled to a fine of EUR 1,000. In practice, however, fines are only imposed if they are significantly exceeded.

25. How are the costs of business registration?

You should bear in mind that almost every certificate costs money. Normally costs are between 10 to 50 euros per document but the prices may differ from one state to another. There might be some extra charges if you are required to submit some extra documents.

If you have any questions or need more information about us, you may fill out the form below: